Economics: Economics is the social science that analyzes the

production, distribution, and consumption of goods and services. The term

economics comes from the Ancient Greek “oikonomia”, where ‘oikos’

means "house" and ‘nomos’ means “custom" or

"law". In this sense “oikonomia” means "management of a

household, or "rules of the house".

There are a variety of modern definitions of

economics. Some of the differences may reflect evolving views of the subject or

different views among economists.

Alfred Marshall provides a still widely-cited definition in his textbook Principles of Economics (1890) that extends analysis beyond wealth and from the societal to the macroeconomic level: Economics is a study of man in the ordinary business of life. It enquires how he gets his income and how he uses it. Thus, it is on the one side, the study of wealth and on the other and more important side, a part of the study of man.

Lionel Robbins (1932) developed implications of what has been termed "perhaps the most commonly accepted current definition of the subject". Economics is a science which studies human behaviour as a relationship between ends and scarce means which have alternative uses.

Lastly we can

say that, the theories, principles, and models that deal with how the market

process works. It attempts to explain how wealth is created and distributed in

communities, how people allocate resources that are scarce and have many

alternative uses, and other such matters that arise in dealing with human wants

and their satisfaction.

Q2. Discuss the subject-matter of Economics (Nov’11).

The subject matter of Economics is

the economic behaviour of man which is highly unpredictable. Money which is

used to measure outcomes in Economics is itself a dependent variable. It is not

possible to make correct predictions about the behaviour of economic variables.

Various economists have different views about the

subject matter of economics. Adam smith, in his book “An Inquiry into the

nature and causes of Wealth of Nations which was published in 1776 defined

economics as an enquiry into the nature and causes of wealth of Nations in

other words it lays importance on wealth rather than welfare of human beings.

It shows to a man uses wealth produces wealth and how wealth is exchanged and

distributed in the economy.

According to the 19th century economists

Alfred Marshall, “Economics is the study of mankind in the ordinary business of

life. It enquires how he gets his income and how he uses it. It examines that

part of individual and social action, which is most closely connected with the

attainment and with the use of material requisites of well-being.

It is on the one side a study of wealth and on the

other and more important side is a part of the study of man”. Professor

Marshall has shifted the emphasis from wealth to man. Alfred Marshall gives

priority to human beings and placed wealth at secondary level.

If we talk about Robbins concept of subject matter

of economics, according to Robins, it studies behavior of a man and relates it

between ends and scarce resources which have alternative uses. According to Robbins wants are unlimited in

number while means are scarce, not only limited but alternative uses. The main problems arises that how to utilize

the scarce resource to fulfill the unlimited wants is a subject matter of

economics.

According to modern economist like Peterson and

Samuelson the subject matter of economics is a science that studies only those

activities of human being which he undertakes to maximize his satisfaction by

making proper use of scarce resources.

All these

economists have combined in their definition the essential elements of the

definitions by Marshall and Robbins. According to modern economists the

efficient allocation and use of scarce means results in increase in economic

growth and social welfare is promoted.

Q3.

State and explain the definition of Economics provided by Alfred Marshall.

Alfred Marshall provides

a still widely-cited definition in his textbook Principles of Economics (1890)

that extends analysis beyond wealth and from the societal to the macroeconomic

level:

"Economics

is a study of man's action in the ordinary business of life it inquires how he

gets his income and how he uses it. It examines that part of individual and

social actions which is mostly closely connected with the attainment and with

the use of material requisites of well being. Thus economics is on one side a

study of wealth and on the other and important side a part of the study of man

".

Features of Marshall’s definition:

1)

Economics is interested

in human welfare not in wealth

2)

It is a social science.

A person who is cut away from the society is not the subject of study of economics.

3)

Economics does not study

of all the activities of man. It only studies ordinary business of life.

4)

Economics is a concerned

with the ways in which a man works on natural resources for the satisfaction of

material wants.

Criticisms of Marshall’s Definition: In 1931, Lionel Robbins published his book “Nature and Significance of Economics Science”, following are the grounds of his criticism of neoclassical economics definition by Alfred Marshall.

1. Narrow down the Scope of Economics: According to Prof. Lionel Robbins the use of the word “Material” in Marshall’s definition narrows down the scope of economics. There are many things in the world, which are non material but they are very significant for promoting human welfare.

For example the services of doctors,

lawyers, teachers, engineers, professors etc. these thing satisfy our wants and

are scarce in supply. If we exclude these services from the economics, then its

cope will be very much restricted. Therefore, in the actual study of economics

principles, both the material and immaterial things are taken into accounts.

2.

Classificatory Type of Definition: Marshall’s

definition was rejected by Robins as being classificatory because it makes a

distinction between material and immaterial welfare and says that economic is

concerned only with material welfare.

3.

Relation between Economics and Welfare: Robbins hardly

criticized Marshall’s definition due to the reason of the relation between

economics and welfare. Robins said that there are many activities which do not

promote human welfare but they can satisfy their wants and therefore, can be

regarded economic activities, for example the manufacturing and sale of alcohol

goods or opium etc. here Robins says “whey talk of welfare at all? Why not

throw away the mask along altogether?”

4.

Welfare is a Vague Concept: Professor Robins raised another objection

about “Welfare”. In Robbins opinion, welfare is a vague concept. It is purely

subjective. It differs from man to man, from place to place and from age to age.

Robins says that what is the use of a concept which cannot be quantitatively

measured and on which two persons cannot agree as to what is conducive to

welfare and what is not.

5.

Involves Value Judgment: Robins object that the word “Welfare”

involves value judgment. According to Robbins the work of the economists is not

to judge the value of a commodity whether it promotes welfare or not.

Economists are forbidden to pass any decision.

6.

Impractical: The definition of economics by Alfred Marshall is of

theoretical nature. Alfred Marshall definition of economics is not possible in

practice to divide human activities.

Q4. Discuss the importance of the study of Economics (Nov’03, May’09,

Nov’ 10).

Importance of the study of Economics: The Importance /advantages/ Objectives of

the study of economics are as under:

(1) Intellectual Value: The knowledge of Economics is very useful as it broadens our outlook, sharpens our intellect, and inculcates in us the habit of balanced thinking. The study of Economics makes us realize that we as human beings are dependent upon one another for our daily needs. This feeling creates in us the intelligent appreciation of our position and the spirit of co-operation with others.

(2) Practical Advantages: The practical advantages of Economics are much more important than its theoretical advantages. These advantages can be looked at from the individual and community point of view.

(3) Personal Stake in Economics: From personal point of view, the study of Economics is useful as it enables each of us to understand better and appreciate more intelligently the nature and significance of our money earning and money spending activities. With the knowledge of Economics, the consumer can better adjust his expenditure to his income. The study of Economics is also useful to a producer. It suggests him the ways of bringing about the most economical combinations of the various factors of production at his disposal. It also helps in solving the various intricacies of exchange. From the study of Economics, one can easily judge as to why the prices have risen or fallen. The knowledge of Economics also explains us as to how the reward of various factors of production is determined. Thus, we find that every’ individual can rightly hope to become a better and more efficient consumer, producer and businessman, if he has the working knowledge of economics.

(4) Economics for the Leader: The study of economics is not only helpful from the individual point of view but it is also very useful for the welfare of the community. It enables a statesman to understand and better grasp the economic and social problems facing the country. Every government has to tackle different kinds of economic problems such as unemployment, inflation, over production, under-production, imposition of tariffs and control, problem of monopolies, etc. the statesman can successfully solve these problems, if he has thorough knowledge of the subject of Economics. The knowledge of Economics for a finance minister is also indispensable. He has to raise revenue by imposing taxes on the incomes of the people for meeting the necessary expenditure of the government. Economics here comes to his rescue and guides him as to how the taxes could be levied and collected.

(5) Poverty and Development: The greatest advantage of Economics is that it helps in removing traces of poverty from the country. Take the case of Pakistan; we in Pakistan are confronted with different kinds of problems. For example, low-per capita income, low productivity of agriculture, slow development of industries, fast increase in population, under-developed means of communication and transport, etc. The study of Economics helps in devising ways and means and suggesting practical measures in solving these problems.

(6) Economics for the citizen: Such being, the importance of study of Economics, it is rightly remarked by Wooten that “you cannot be in real sense a citizen unless you are also in some degree an economist”. He is perfectly right in giving the statement. The world is so fast changing that we are completely now living in a world dominated by economic forces and economic ideas. If the people of any country do not have the working knowledge of an economic system; then the government of that country can easily hoodwink citizens have knowledge of Economics, then the government will be very vigilant and spend the money in a wise manner.

The importance of the study

of Economies can also be judged from this fact that the daily newspapers cannot

be understood without some knowledge of Economics. The newspapers often

describe complicated economic problems such as inflation, balance of payment,

balance of trade, imperfect markets, dumping, co-operative farming,

sub-division and fragmentation of holdings, mechanization of agriculture, If

you do not have working knowledge of Economics, you cannot understand these

diverse problems.

From brief discussion, we

conclude, that the knowledge of Economics is very useful. As such it is

necessary that every citizen, bankers, worker, administrator, consumer, etc.,

should have at least working knowledge of it. In the words of Sir Henry

Clay: “Some study of Economics is at one a practical necessity and a normal

obligation”.

Q5. Distinguish between micro-economics and macro-economic (Nov’03,

Nov’12).

Difference between Microeconomics and Macroeconomics:

Microeconomics

|

Macroeconomics

|

1. It is that branch of

economics which deals with the economic decision-making of individual

economic agents such as the producer, the consumer, etc

|

1. It is that branch of

economics which deals with aggregates and averages of the entire economy,

e.g., aggregate output, national income, aggregate savings and investment,

etc.

|

2. It takes into account

small components of the whole economy.

|

2. It takes into

consideration the economy of any country as a whole.

|

3. It deals with the

price-determination in case of individual products and factors of production.

|

3. It deals with general

price-level in any economy.

|

4. It is known as price

theory (since it explains the process of allocation of economic resources

along alternative lines of production on the basis of relative prices of

various goods and services).

|

4. It is also known as

the income theory (since it explains the changing levels of national income

in any economy during any particular time period).

|

5. It is concerned with

the optimisation goals of individual consumers and producers (e.g.,

individual consumers are utility-maximisers, while individual producers are

profit-maximisers).

|

5. It is concerned with

the optimisation of the growth process of the entire economy.

|

6. It studies the flow of

economic resources or factors of production from any individual owner of such

resources to any individual user of these resources, etc.

|

6. It studies the

circular flow of income and expenditure between different sectors of the

economy (say, between the firm sector and household sector).

|

7. Microeconomic theories

help us in formulating appropriate policies for resource allocation at the

firm level.

|

7. Macroeconomic theories

help us in formulating appropriate policies for controlling inflation (i.e.,

rising price-level), unemployment, etc.

|

8. It takes into account

the aggregates over homogeneous or similar products (e.g., the supply of

steel in an economy).

|

8. It takes into account

the aggregates over heterogeneous or dissimilar products (say, the Gross

Domestic Product of any country during any year.

|

Q6. What are the main goals of macro-economic policy (Dec’12)?

Macroeconomic goals:

Three conditions of the mixed economy that are most important for

macroeconomics, including full employment, stability, and economic growth, that

are generally desired by society and pursued by governments through economic

policies.

Macroeconomic

goals are three of the five economic goals of a mixed economy that are most

important to the study of macroeconomics. They are full employment, stability,

and economic growth.

Full Employment: Full employment is achieved when all available resources (labour, capital, land, and entrepreneurship) are used to produce goods and services. This goal is commonly indicated by the employment of labour resources (measured by the unemployment rate). However, all resources in the economy--labour, capital, land, and entrepreneurship--are important to this goal. The economy benefits from full employment because resources produce the goods that satisfy the wants and needs that lessen the scarcity problem. If the resources are not employed, then they are not producing and satisfaction is not achieved.

Stability: Stability is achieved by avoiding or limiting fluctuations in production, employment, and prices. Stability seeks to avoid the recessionary declines and inflationary expansions of business cycles. This goal is indicated by month-to-month and year-to-year changes in various economic measures, such as the inflation rate, the unemployment rate, and the growth rate of production. If these remain unchanged, then stability is at hand. Maintaining stability is beneficial because it means uncertainty and disruptions in the economy are avoided. It means consumers and businesses can safely pursue long-term consumption and production plans. Policies makers are usually most concerned with price stability and the inflation rate.

Economic Growth: Economic growth is achieved by increasing the economy's ability to produce goods and services. This goal is best indicated by measuring the growth rate of production. If the economy produces more goods this year than last, then it is growing. Economic growth is also indicated by increases in the quantities of the resources--labour, capital, land, and entrepreneurship--used to produce goods. With economic growth, society gets more goods that can be used to satisfy more wants and needs--people are better off; living standards rise; and scarcity is less of a problem.

Q7. Explain the terms “Want” and

“Scarcity” as understood in Economics (Nov’08,’11).

Wants: Want

may be defined as an insatiable desire or need by human beings to own goods or

services that give satisfaction. The basic needs of man include; food, housing

and clothing. Human needs are many.

They include tangible goods like houses,

cars, chairs, television set, radio, etc. while the others are in form of

services, e.g. tailoring, carpentary, medical, etc. Human wants and needs are

many and are usually described as insatiable because the means of satisfying

them are limited or scarce.

Scarcity:

Scarcity

can be defined as a situation in which human wants are greater than the

capacity of available resources to provide for those wants. In other words, it

means that people want more than is available. Economic resources are limited,

but human needs and wants are infinite. Indeed the development of society can

be described as the uncovering of new wants and needs - which producers attempt

to supply by using the available factors of production.

Making choices Because of scarcity, choices have to be made on a daily basis by all consumers, firms and governments.

Making choices Because of scarcity, choices have to be made on a daily basis by all consumers, firms and governments.

Q8. Discuss the importance of

multiplicity of wants and scarcity of resources in the study of Economics

(Nov’08 and Nov’11)

Q9.

How does a private sector firm maximize its profits (Nov’08, Nov’09, May’07, and

May’08)?

In economics, profit

maximization is the short run or long run

process by which a firm determines the price and output level that returns the greatest profit. There are several approaches to this

problem. The total revenue–total cost perspective relies on the fact that

profit equals revenue minus cost and focuses on maximizing this difference, and

the marginal revenue–marginal

cost perspective is based on the fact that total profit reaches its maximum

point where marginal revenue equals marginal cost.

The proprietors of those private firms,

treat their staff professionally Provide a conductive working environments for

their staff to work in comfort. Regard their marketing departments and their

sales persons as important personnel, to bring in business for the various

departments of their firms to process and turn those business and services into

finished goods or services to sell or provide to their customers so that

profits can be made.

Q11. What are the main objectives of a

firm in the private sector? (Nov’05,’06)

The main objectives of a firm in the private sector: Basically the main key objective of the private sector is to get the highest profit as much as they can get. The profit is the Earning before interest and tax. Taxes are government sanctioned and the private sector tries to give a great cushion to EBIT against interest and tax. To achieve this aim, the companies in the private business produce, where their total revenues are far higher than total costs. This creates high reserves for the stockholders.

This indicates that the private sector

has to accomplish the goals and desires of the shareholders and it will always

aim to fulfil their satisfaction. Another objective of companies in the private

sector is to raise their market shares to get a sustainable competitive

advantage. Companies involved in the private sector also strive to improve

their corporate image by showing social responsibility. In addition, the

private sector is highly involved in sponsoring and participating in social and

community events because they know that such events can make their positioning

and image better in the market.

Q12. What do you mean by price Elasticity

of demand? Distinguish between elastic and inelastic demand.

Price Elasticity of demand: A measure of the relationship between changes in the quantity demanded of a particular good and a change in its price. Price elasticity of demand is a term in economics often used when discussing price sensitivity. The formula for calculating price elasticity of demand is:

Price Elasticity of Demand = % Change in Quantity Demanded / % Change in Price

If a small change in price is accompanied by a large change in quantity demanded, the product is said to be elastic (or responsive to price changes). Conversely, a product is inelastic if a large change in price is accompanied by a small amount of change in quantity demanded.

For example, if the quantity demanded for

a good increases 15% in response to a 10% increase in price, the price

elasticity of demand would be 15%

/ 10% = 1.5.

The main differences between an

elastic demand and an inelastic demand have been explained in details as

follows:

Elastic Demand:

- When a small change in price brings about more than proportionate change in demand, it is known as the elastic demand.

- The demand curve is flatter.

- Luxuries and comforts have elastic demand.

- Examples of elastic demand are Color T.V. sets, Prestige goods, etc.

- Perfectly elasticity of demand is not practical, while relative elasticity is seen in case of moderately priced goods.

- The coefficient of elasticity of demand is greater than 1, that it ed > 1.

Inelastic Demand:

- When a big change in price brings about less than proportionate change in demand, it is known as inelastic demand.

- The demand curve is steeper.

- Necessary items can be termed as inelastic demand.

- Examples of Inelastic demand are salt, rice, food grains, etc.

- Perfectly inelasticity of demand is seen in the demand of necessary goods, while relative inelasticity is seen in case of very expensive goods.

- The coefficient of elasticity of demand is less than 1, that is ed < 1.

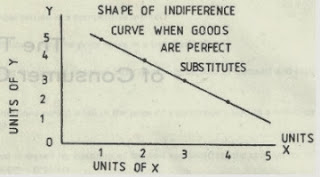

Q13. What is an indifference curve and

what are its characteristics/properties? Use diagrams in your answer (Nov’03,

Nov’04, Nov’07, Nov’09, and Nov’10).

An indifference curve:

Definition: An

indifference curve is a graph showing combination of two goods that give the

consumer equal satisfaction and utility. Each point on an indifference curve

indicates that a consumer is indifferent between the two and all points give

him the same utility.

Description:

Graphically, the indifference curve is drawn as a downward sloping convex to

the origin. The graph shows a combination of two goods that the consumer

consumes.

The above diagram shows the U indifference curve

showing bundles of goods A and B. To the consumer, bundle A and B are the same

as both of them give him the equal satisfaction. In other words, point A gives

as much utility as point B to the individual. The consumer will be satisfied at

any point along the curve assuming that other things are constant.

Characteristics/properties of an indifference curve:

Following are the

indifference curve properties:

2. When two commodities are

not substitutable then the shape is represented by two vertical and horizontal

lines.

3. In more typical cases, in which the two commodities can be substituted for each other but are not perfect substitutes, the indifference curve will be curved as

4. The more easily the two commodities can be substituted for each other the nearer will the curve approach straight line.

5. Indifference curves normally slope downward, the upward sloping portion of curve shown here s impossible. Basket A has more goods than basket B and therefore it could not be on the same indifference curve. The indifference curves have normally negative slops – sloping downward.

6. The absolute value of the slope of an

indifference curve at any point represents the ratio of the marginal utility of

the good and on the horizontal axis to the marginal utility of the good on the

vertical axis. The rate at which one good can be substituted for the other

without gain or loss in satisfaction is called marginal rate of substitution.

7. Indifference curves are convex, that

is, their slope decrease as one moves down and to the right along them. The

implies that the ratio of the marginal utility of meat to the marginal utility

of the ghee (cooking oil) also known as marginal ratio of substitution of meat

for ghee (cooking oil) diminishes as one moves down and to the right along the

curve.

8. Indifference curves can be drawn

through the point that represents the basket of goods whatsoever.

Q14. Explain with the help of an

indifference curve analysis how a consumer reaches the highest level of

satisfaction? (May’06, Nov’07 and Nov’10).

Consumer’s Equilibrium by Indifference Curve: Consumer equilibrium refers to a situation, in which a consumer derives maximum satisfaction, with no intention to change it and subject to given prices and his given income. The point of maximum satisfaction is achieved by studying indifference map and budget line together.

Conditions of Consumer’s Equilibrium: The consumer’s equilibrium under the indifference curve theory must meet the following two conditions:

(i) MRSXY = Ratio of prices or PX/PY

Let the two goods be X and Y. The first condition for consumer’s

equilibrium is that

MRSXY = PX/PY

A) If MRSXY > PX/PY, it means that the consumer is willing to pay more for X than the price prevailing in the market. As a result, the consumer buys more of X. As a result, MRS falls till it becomes equal to the ratio of prices and the equilibrium is established.

B) If MRSXY < PX/PY, it means that the consumer is willing to pay less for X than the price prevailing in the market. It induces the consumer to buys less of X and more of Y. As a result, MRS rises till it becomes equal to the ratio of prices and the equilibrium is established.

(ii) MRS continuously falls:The second condition for consumer’s equilibrium is that MRS must be diminishing at the point of equilibrium, i.e. the indifference curve must be convex to the origin at the point of equilibrium. Unless MRS continuously falls, the equilibrium cannot be established.

Thus, both the conditions need to be fulfilled for a consumer to be in

equilibrium.

Let us now understand this with the help of a diagram:

In Fig. 2.12, IC1, IC2 and IC3 are the three indifference curves and AB is the budget line. With the constraint of budget line, the highest indifference curve, which a consumer can reach, is IC2. The budget line is tangent to indifference curve IC2 at point ‘E’. This is the point of consumer equilibrium, where the consumer purchases OM quantity of commodity ‘X’ and ON quantity of commodity ‘Y.

All other points on the budget line to the left or right of point ‘E’

will lie on lower indifference curves and thus indicate a lower level of

satisfaction. As budget line can be tangent to one and only one indifference

curve, consumer maximizes his satisfaction at point E, when both the conditions

of consumer’s equilibrium are satisfied:

(i) MRS = Ratio of prices or PX/PY:

At tangency point E, the absolute value of the slope of the indifference

curve (MRS between X and Y) and that of the budget line (price ratio) are same.

Equilibrium cannot be established at any other point as MRSXY > PX/PY

at all points to the left of point E and MRSXY < PX/PY

at all points to the right of point E. So, equilibrium is established at point

E, when MRSXY = PX/PY.

(ii) MRS continuously falls:

The second condition is also satisfied at point E as MRS is diminishing

at point E, i.e. IC2 is convex to the origin at point E.

Q15. What is meant by production function?

Describe a production indifference curve and its properties. Use diagram in

your answer. (Nov’11 and Nov’10)

Productions

function: Production is the process by which inputs are

transformed in to outputs. Thus there is relation between input and output. The

functional relationship between input and output is known as production

function.

In economics, equation that expresses the

relationship between the quantities of productive factors (such as labour and

capital) used and the amount of product obtained. It states the amount of

product that can be obtained from every combination of factors, assuming that

the most efficient available methods of production

are used.

It can be expressed in algebraical form

as under:

x =f (al, a2,……………………………

an)

This

equation tells us the quantity of the product X which can be produced by the

given quantities of inputs (lands labour, capital) that are used in the process

of production. Here, it may be noted that production function shows only the

maximum amount of output it which can be produced from given inputs. It is

because production function includes only efficient production process.

A production indifference curve and its

properties:

(1)

Indifference Curves are Negatively Sloped: The

indifference curves must slope down from left to right. This means that an

indifference curve is negatively sloped.

In fig. 3.4 the two combinations of commodity cooking

oil and commodity wheat is shown by the points a and b on the same

indifference curve. The consumer is indifferent towards points a and b as they represent equal level of satisfaction.

(2) Higher Indifference Curve Represents Higher Level: A higher indifference curve that lies above and to the right of another indifference curve represents a higher level of satisfaction and combination on a lower indifference curve yields a lower satisfaction.

In this diagram (3.5) there are three indifference curves, IC1, IC2 and IC3 which represents different levels of satisfaction. The indifference curve IC3 shows greater amount of satisfaction and it contains more of both goods than IC2 and IC1 (IC3 > IC2 > IC1).

(3) Indifference Curve is Convex to the Origin: This is an important property of indifference curves. They are convex to the origin (bowed inward). This is equivalent to saying that as the consumer substitutes commodity X for commodity Y, the marginal rate of substitution diminishes of X for Y along an indifference curve.

(4)

Indifference Curve Cannot Intersect Each Other: Given

the definition of indifference curve and the assumptions behind it, the

indifference curves cannot intersect each other. It is because at the point of

tangency, the higher curve will give as much as of the two commodities as is

given by the lower indifference curve. This is absurd and impossible.

In fig 3.7, two indifference curves are showing

cutting each other at point B. The combinations represented by points B and F

given equal satisfaction to the consumer because both lie on the same

indifference curve IC2. Similarly the combinations shows by points B

and E on indifference curve IC1 give equal satisfaction top the

consumer.

(5) Indifference Curves do not Touch the Horizontal or Vertical Axis: One of the basic assumptions of indifference curves is that the consumer purchases combinations of different commodities. He is not supposed to purchase only one commodity. In that case indifference curve will touch one axis. This violates the basic assumption of indifference curves.

Q16. Define production function. Show

with the help of a diagram the relationship among ‘total product (TP)’,

‘marginal product (MP)’, and ‘average product (AP)’. (Nov’04,’08,’12)

Total product (TP): Total product is the amount of output produced from land with given number of laborers employed.

Average

Product (APL): The

average product of labor (APL) is total product (TP) divided by the

number of laborers employed APL = TPL/L

Marginal

product (MPL): The

marginal product of labor (MPL) is the change in the total product

due to a change in labor. MPL = ΔTP/ΔL

In

our example in table 1, there are increasing returns to labor for the first

three units of labor employed. The law of diminishing returns sets in with

addition of the fourth worker. Both the average and the marginal products

increase at first and then decline. The marginal product declines faster than

the average product. When 8 men are employed, total product is at a maximum.

The marginal product of the 9th laborer is negative.

Thus,

1.

If

MP > 0, TP will be increasing as L increases

2.

If

MP = 0, TP will be constant as L increases

3.

IF

MP < 0, TP will be falling as L increases.

Table1:

Properties of total product, marginal product and average product curves during

the three stages of production

Total

Product

|

Marginal Product

|

Average Product

|

Stage I (Increases at an increasing rate)

|

Increases

|

Increases

|

Stage I (Increases at a diminishing rate)

|

Reaches a maximum and begins to diminish

|

Continues to increase

|

Stage II (Continues to increase at a diminishing

rate)

|

Continues to diminish

|

Reches maximum and begins to diminish

|

Stage II (Reaches maximum)

|

Becomes zero

|

Continues to diminish

|

Stage III (Diminishes)

|

Becomes negative

|

Continues to diminish but must always be greater

than zero

|

Q17. Outline the

differences between a perfectly competitive market and a monopoly market.

(Nov’07, Nov’10)/ (Principal features of them, Dec'13).

Perfect Competitive Market: A market with perfect competition is where there are a very large number of buyers and sellers who are buying and selling an identical product. Since the product is identical in all its features, the price charged by all sellers is a uniform price. Economic theory describes market players in a perfect competition market as not being large enough by themselves to be able to become a market leader or to set prices. Since the products sold and prices set are identical, there are no barriers to entry or exit within such a market place.

Monopoly market (Dec'13): A Monopoly market is one where

there are a large number of buyers but a very few number of sellers. The

players in these types of markets sell goods which are different to each other

and, therefore, are able to charge different prices depending on the value of

the product that is offered to the market. In a monopolistic competition

situation, since there are only a few numbers of sellers, one larger seller

controls the market, and therefore, has control over prices, quality and

product features.

Difference between Perfect

Competition and Monopoly Competition: Perfect and Monopoly competition marketplaces have

similar objectives of trading which is maximizing profitability and avoid

making losses. However, the market dynamics between these two forms of markets

are quite distinct. Monopoly competition describes an imperfect market

structure quite opposite to perfect competition. Perfect competition explains

an economic theory of a marketplace which does not happen to exist in reality.

Perfect

Competition vs Monopoly Competition

- Perfect and Monopoly competitions are both forms of market situations that describe the levels of competition within a market structure.

- A market with perfect competition is where there are a very large number of buyers and sellers who are buying and selling an identical product.

- A Monopoly market is one where there are a large number of buyers but a very few number of sellers. The players in these types of markets sell goods which are different to each other, and therefore, are able to charge different prices.

- Monopoly competition describes an imperfect market structure quite opposite to perfect competition.

- Perfect competition explains an economic theory of a marketplace which does not happen to exist in reality.

Q19. Analyze the

short-run equilibrium of a firm under monopoly (Nov’04,’05, 07)?/How output and

price are determined by a monopoly firm (Dec'13)?

Short-run equilibrium: Producers in monopolistically competitive markets, as well as all market types, are profit maximizes. This means they will produce at the quantity for which their Marginal Benefit is maximized; a.k.a. where Marginal Cost equals their Marginal Revenue (MC=MR). If you draw a vertical line from the intersection point down to the x-axis, that is the market quantity. To find the price, you must extend the vertical line up to the Demand curve because Demand relates market price to quantity, not the Marginal Cost curve. Then draw a horizontal line to the y-axis and that is the market price. These two values represent the short-run equilibrium for a monopolistically competitive market.

Long Run Equilibrium: Since producers are profit maximizes, they will produce the quantity

where MC=MR (same procedure as for the short-run equilibrium). In a

monopolistically competitive market there are low barriers to

entry so it is easy for other firms to come in and steal economic profit

from the firms currently in the market. To counteract this, producers in the

market will produce at a quantity that yields zero economic profit, because why

would you join this market if there's no supernormal profit? This means the

quantity the firm produces will be both where MC=MR and Price (the Demand

curve) intersects the Average Total Cost curve. If you draw a vertical line up

from the market quantity, it will go through both of these points. The price is

again found by drawing a horizontal line to the y-axis.

PRICE AND OUTPUT DETERMINATION UNDER MONOPOLY (Dec'13): The object of the monopolist is to earn maximum profit. The

monopolist will charge such a price which will give him the maximum profit. He

always compares marginal revenue with cost at its output rate. The profit of

firm is maximum when its MR = MC and Marginal cost curve cuts the marginal

revenue curve from below. The MR curve in negatively sloped and it also lies

below the AR curve at all levels of output, except the first unit. The

monopolist controls the whole market and no new firm can enter into the market

so the distinction between a long run and short run is not necessary. The price

and output determination can be explained by the following diagram.

EXPLANATION: - In this diagram AR curve is higher than the MR

curve. The MC curve cuts the MR curve at a point E. Equilibrium occurs at a

point E, where MR = MC. So the best level of output for the monopolist firm is

OF. As regards the determination of price monopolist fixes the price OP because

the total revenue of the firm will be maximum at the equilibrium output OF.

The cost of the firm will be = OSEF the revenue of the firm will be = OPKF.

The cost of the firm will be = OSEF the revenue of the firm will be = OPKF.

Q20. Is there a supply

curve for a monopoly firm, explain (Nov’07, Dec'13)?

Answer: The monopoly firm has no supply curve that is independent of the demand curve for its product.

The explanation about no supply curve for monopoly curve is following:

The monopolist is the single seller so we don’t need to aggregate all

the individual firms’ marginal cost curves to obtain the industry supply curve.

The monopolist’s output decision depends not only on its marginal cost, but

also on the demand curve. Thus, shifts in demand lead to changes in price, in

output or both. There is no one-to-one correspondence between the price and the

seller’s quantity, unlike in perfect competition.

At last we can say, because the monopolist's supply decision cannot be

set out independently of demand. Since supply curve tells us the

quantity that a firm chooses to supply at any given price and on the other

hand, a monopoly firm is a price maker; the firm sets the price and at the same

time it chooses the quantity to supply. The market demand curve tells

us how much the monopolist will supply.

Q21.

What is Inflation and why does it occur (Dec'13)?

Inflation: In

terms of economics, inflation can simply be defined as an elevation in the

general price levels of services and goods in the economy over a particular

period of time. Whenever the price level increases it causes depletion in the

buying capacity of the currency, so inflation can also be defined as erosion in

the purchasing power of money i.e. a loss of the real value of money in an

internal medium of the exchange. One most common measure of price inflation is

inflation rate. Inflation rate can be calculated as the yearly percentage

change in the general price index (Consumer Price Index to be used most

commonly) over time.

Reasons

of inflation: Situation of inflation can occur at any time, and its

occurrence depends upon a number of reasons. No specific cause is responsible

for the occurrence of inflation. But some proposed reasons of the inflation are

mentioned below-

1. If the production cost of various

services and goods increases then naturally the prices of the final products

would also increase. This leads into the situation of inflation.

2. Inflation occurs when industries and

business houses increase the total prices of their services and goods in order

to amplify their profit margins. This category of inflation is called as

“administered price inflation” or “pricing power inflation”. This type of

inflation is tedious to tackle because various industries and business houses

have the complete authority/power of pricing their services and goods.

3. A situation of inflation occurs when a

specific section of a mass industry increases the prices of its services and

goods, because this step of a particular section of a mass industry will

produce considerable effects on various other sections of industry also. For

example- increase in the price of crude oil will spontaneously cause increase

in the train fares and airfares.

4. A special category of inflation known

as “Fiscal inflation” occurs, because of excessive spending of the government.

Fiscal inflation was first observed in United Sates of America at the time of

President Mr. Lydon Baines Johnson.

5. One another type of inflation is known

as hyperinflation. Hyperinflation occurs during or after a heavy war. This

inflation is also popular with the name of galloping inflation.

6. Another severe type of inflation is

known as stagflation. It occurs in an economy which faces economic stagnation

and high unemployment rate.

So we can say that inflation has some

serious consequences on the economy as a whole. So the government should make

some strict policies to curb inflation and thus help the country to have a

stable economy.

Q22.

Discuss the instruments of monetary policy (Dec'13). How monetary policy can be used to

control inflation?

The statutory liquidity requirement (SLR), as a monetary policy instrument, has experienced infrequent changes in Bangladesh. Past evidence shows that reduction in SLR produced positive impact on bank credit and investment especially prior to the 1990s. In recent times, changes in SLR and cash reserve requirement (CRR) helped to reduce inflation to some extent in some years. Since the 1990s, Bangladesh Bank has used open market operations (OMOs), more frequently rather than changes in the Bank Rate and SLR as instruments of monetary policy in line with its market oriented approach. In this context, it should be noted that lately Bangladesh depends mostly on the money market as the channel for monetary transmission rather than changes in reserve requirements. The CRR and SLR for scheduled banks are used only in situations of drastic imbalance resulting from major shocks. The effectiveness of SLR in bringing about desired outcomes, however, depends on appropriate adjustments of other indirect monetary policy instruments such as repo and reverse repo rates.

Repo Rate: The repo rate also known as Repurchase Agreement is the rate at which the banks borrow from the Central Bank. It becomes typical for the banks to borrow from the central bank if there is an increase in the repo rate. Generally used to control the amount of money in the market, repo rate is usally a short-term measure which is used for short-term loans.

Reverse Repo: The Federal Open Market Committee adds reserves to the banking system and withdraws them after a specified period of time. So, reverse repo drains reserves initially and adds them back later. Hence, it can be used as a tool for stabilizing interest rates with the Federal Reserve using it in the past to adjust the Federal funds rate to match the target rate.

Monetary policy can be used to control inflation: The primary job of the Central Bank is to control inflation while avoiding a recession. It does this with monetary policy. To control inflation, the Central Bank must use contractionary monetary policy to slow economic growth. If the GDP growth rate is more than the ideal of 2-3%, excess demand can generate inflation by driving up prices for too few goods.

The Central Bank can slow this growth by

tightening the money supply, which is the total amount of credit allowed into

the market. The Central Bank action reduces the liquidity in the financial

system, making it becomes more expensive to get loans. This slows economic

growth and demand, which puts downward pressure on prices.

Q23.

Short notes:

A) What is Cross-elasticity of demand (May’11, May’12, and Dec’12, Dec'13)?

Cross-elasticity of demand: In economics, the cross elasticity of demand or cross-price elasticity of demand measures the responsiveness of the demand for a good to a change in the price of another good. It is measured as the percentage change in demand for the first good that occurs in response to a percentage change in price of the second good. For example, if, in response to a 10% increase in the price of fuel, the demand of new cars that are fuel inefficient decreased by 20%, the cross elasticity of demand would be: -20%/10%=-2

A

negative cross elasticity denotes two products that are complements, while a

positive cross elasticity denotes two substitute products. These two key

relationships may go against one's intuition, but the reason behind them is

fairly simple: assume products A and B are complements, meaning that an

increase in the demand for A is caused by an increase in the quantity demanded

for B. Therefore, if the price of product B decreases, then the demand curve

for product A shifts to the right, increasing A's demand, resulting in a negative

value for the cross elasticity of demand. The exact opposite reasoning holds

for substitutes.

The

formula used to calculate the coefficient cross elasticity of demand is EA,B=% Change in quantity

demanded of product A/% Change in price of product B

B) What is

meant by opportunity cost (May’11, Nov’11, and Dec’12)?

Opportunity cost: Opportunity cost is the cost of any activity measured in terms of the value of the next best alternative that is not chosen. It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices.

The opportunity cost is a key concept in economics,

and has been described as expressing "the basic relationship between

scarcity and choice".

Example: The difference in return between a chosen investment and one that is necessarily passed up. Say you invest in a stock and it returns a paltry 2% over the year. In placing your money in the stock, you gave up the opportunity of another investment - say, a risk-free government bond yielding 6%. In this situation, your opportunity costs are 4% (6% - 2%).

C)

What is Basel II Accord (Nov’10, Dec’12)?

Basel II Accord: The Basel Accords

determine how much equity capital - known as regulatory capital - a bank must

hold to buffer unexpected losses. Equity is assets minus liabilities. For a

traditional bank, assets are loans and liabilities are customer deposits. But

even a traditional bank is highly leveraged (i.e., the debt-to-equity or

debt-to-capital ratio is much higher than for a corporation). If the assets

decline in value, the equity can quickly evaporate. So, in simple terms, the

Basel Accord requires banks to have an equity cushion in the event that assets

decline, providing depositors with protection.

The

regulatory justification for this is about the system: If big banks fail, it

spells systematic trouble. If not for this, we would let banks set their own

levels of equity -known as economic capital - and let the market do the

disciplining. So, Basel attempts to protect the system in much the same way

that the Federal Deposit Insurance Corporation (FDIC) protects individual

investors.

D)

What is Quasi-rent (Nov’11)?

Quasi-rent: Quasi-rent

is like economic rent, but usually larger, because it is the excess of return

over short run opportunity cost, which does not include the fixed cost of

replacing or duplicating fixed assets such as a piece of capital or an

invention. Thus, infra-marginal rent.

For

example at the time of creation of Bangladesh, the demand for houses increased

owning to increase in population. But the supply could not be increased because

of the sacristy of building materials. For the time being, their supply was

much limited as that of land. Rent rose. This abnormal increase in the return

on capital invested in building is nothing but Quasi-rent.

E)

Define Giffen good (May’11, Dec'13).

Giffen good: In economics and consumer theory, a Giffen good is one which people paradoxically consume more of as the price rises, violating the law of demand. In normal situations, as the price of a good rises, the substitution effect causes consumers to purchase less of it and more of substitute goods. In the Giffen good situation, the income effect dominates, leading people to buy more of the good, even as its price rises. Evidence for the existence of Giffen goods is limited, but microeconomic mathematical models explain how such a thing could exist. Giffen goods are named after Scottish economist Sir Robert Giffen, to whom Alfred Marshall attributed this idea in his book Principles of Economics. Giffen first proposed the paradox from his observations of the purchasing habits of the Victorian era poor.

An example At this point, the consumer’s

entire budget is taken up by the giffen good, so any price increase now will

result in a decrease of the amount of good the consumer is able to buy.

Thus, we will have our typical downward sloping demand curve.

F) Explain

Inferior good with example (Nov’10, May’12).

Inferior good: A type of good for which demand declines as the level of income or real GDP in the economy increases. This occurs when a good has more costly substitutes that see an increase in demand as the society's economy improves. An inferior good is the opposite of a normal good, which experiences an increase in demand along with increases in the income level.

An

example of an inferior good is public transportation. When consumers have less

wealth, they may forgo using their own forms of private transportation in order

to cut down costs (car insurance, gas and other car upkeep costs) and instead

opt to use a less expensive form of transportation (bus pass).

G) Define Terms of Trade (May’11,

Dec’12, Dec'13).

Terms of Trade: The

Terms of Trade measures the relative price of exports compared to the price of

imports.

Terms

of Trade

= 100 * Average export prices / Average Import prices.

Basically, the terms of trade refers to how many

exports will need to be sold in order to be able to purchase imports.

i) If the price of exports increases, there will be an improvement in the terms of trade.

ii) If the price of exports falls, there will be a decline in the terms of trade.

Importance of the terms of Trade: To some extent we can use the terms of trade to measure the strength and well-being of an economy. A prolonged fall in the terms of trade will reduce living standards. The US, will find that it can increasingly purchase less imports from abroad. But, at the same time it is also quite limited. For example, devaluation doesn’t necessarily harm a country. Devaluation does make exports more competitive and can increase economic growth.

There is much more to the strength of an economy than the terms of trade.

For example:

- Volumes of trade

- productivity

- capital flows

- economic growth

H)

What is Public good (Nov’11, June’13)?

Public

good:

In economics, a public good is a good that is both non-excludable and

non-rivalrous in that individuals cannot be effectively excluded from use and

where use by one individual does not reduce availability to others.

Examples

of public goods include fresh air, knowledge, lighthouses, national defense,

flood control systems and street lighting. Public goods that are available

everywhere are sometimes referred to as global public goods.

I)

Definition of 'Gresham's Law' (Dec’12, Dec'13).

Gresham's Law: In currency valuation, Gresham's Law states that if a new coin ("bad money") is assigned the same face value as an older coin containing a higher amount of precious metal ("good money"), then the new coin will be used in circulation while the old coin will be hoarded and will disappear from circulation.

Gresham's Law: In currency valuation, Gresham's Law states that if a new coin ("bad money") is assigned the same face value as an older coin containing a higher amount of precious metal ("good money"), then the new coin will be used in circulation while the old coin will be hoarded and will disappear from circulation.

Coins

were first made with gold, silver and other precious metals, which gave them

their value. Over time, the amount of precious metals used to make the coin

decreased because the metals were worth more on their own than when minted into

the coin itself. If the value of the metal in the old coins was higher than the

coin's face value, people would melt the coins down and sell the metal.

Similarly, if a low quality good is passed off as a high quality good, then the

market will drive down prices because consumers won't be able to determine the

good's real value.

J)

Definition of 'Reserve Ratio'/Cash Reserve Ratio/Cash Reserve Requirement

(May’12, June’13).

Reserve

Ratio'/Cash Reserve Ratio/Cash Reserve Requirement: A Cash Reserve

Ratio, also known as the Reserve Requirement is a regulation set by Central

bank (Bangladesh Bank) which dictates the minimum amount (reserves) that a

commercial bank (in some cases, any bank) must be held to customer notes and

deposits. In simpler terms this is the amount the bank must surrender with/to

the Central (governing) Bank.

It is

a percentage of bank reserves to deposits and notes. Cash reserve ratio is also

known as liquidity ratio or cash asset ratio and is utilized as a tool

(sometimes) in monetary policy and as a tool to influence the country’s

interest rates, borrowing and economy.

For

example, if the reserve ratio in the Bangladesh is determined by the central

bank to be 11%, this means all banks must have 11% of their depositors' money

on reserve in the bank. So, if a bank has deposits of 1 billion, it is required

to have 110 million on reserve.

K)

Definition of 'Floating Exchange Rate' (Nov’10, May’12, Dec'13).

Floating

Exchange Rate: A

country's exchange rate regime where its currency is set by the

foreign-exchange market through supply and demand for that particular currency

relative to other currencies. Thus, floating exchange rates change freely and

are determined by trading in the forex market. This is in contrast to a

"fixed exchange rate" regime.

L) What is Cost-Push Inflation (June’13)?

Cost-Push Inflation: When

companies costs go up, they need to increase prices to maintain their profit

margins. Increased costs can include things such as wages, taxes, or increased

costs of imports.

Q24.

“Economics is the study of mankind in the ordinary business of life.”-Discuss

the statement (Dec’12).

Or.

“Economics is a science of wealth.”-Discuss (May’12, Dec'13).

Alfred Marshall provides a still widely-cited definition in his textbook Principles of Economics (1890) that extends analysis beyond wealth and from the societal to the macroeconomic level:

"Economics

is a study of man's action in the ordinary business of life it inquires how he

gets his income and how he uses it. It examines that part of individual and

social actions which is mostly closely connected with the attainment and with

the use of material requisites of well being. Thus economics is on one side a

study of wealth and on the other and important side a part of the study of man

".

From the definition of economics by Alfred

Marshall, we see that he lays emphasizes on the below points.

1.

Study of an ordinary man: According to Alfred Marshall, economics

is that study of an ordinary man who lives in society. It is not concerned with

the lives of only rich persons or who is cut away from the society. Its subject

matter is a particular aspect of human behaviour i.e. earning and spending of

incomes for the normal material needs of human beings.

2.

Economics is not a useless study of wealth: Economics does

not regard wealth as the be-all and end-all of economics activities wealth is

not of primary importance. It is earned only for promoting human welfare

economics is studied to analyze the causes of material prosperity of

individuals and nations.

3.

Economics is a social science: It does not study the behaviour

of isolated individuals but the actions of persons living in society. When

people live together they interact and cooperate to work at firms, factories,

shop and offices to produce and exchange goods or services. The problems about

these activities are studied in economics.

4.

Study of material welfare: According to Alfred Marshall, economics

studies only material requisites of well being or causes of material welfare.

It is cleared from this definition that it is materialistic aspect and ignores

non-material aspects. Alfred Marshall stressed that the man’s behaviour and

activities to produce and consume maximum number of goods and services are the

main object of study wealth is not an end or final aim, but only a means to

achieve a higher objective of welfare.

No comments:

Post a Comment